Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

CONCERNS ABOUT INFLATION DISSIPATED FURTHER IN SEPTEMBER

Hotels, restaurants, and other companies in the hospitality business created new jobs, reflecting strong demand for services such as travel and recreation.

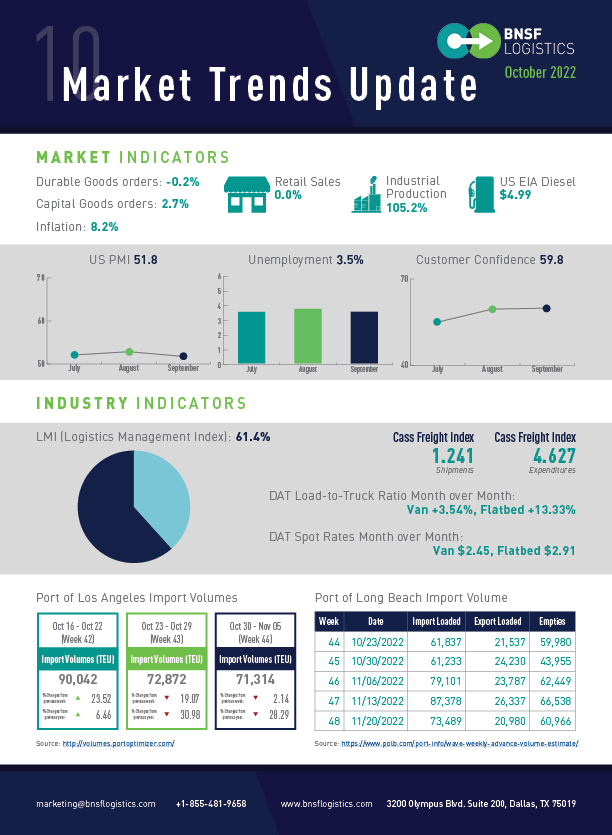

- The unemployment rate dropped to 3.5% from 3.7%.

- The U.S. added 263,000 new jobs in September, a 17-month low.

- Manufacturers also added 22,000 jobs, and construction firms 19,000.

- Labor participation rate fell slightly to 62.3% from 62.4%.

The costs of staples such as food, rent, medical care, and new cars rose last month. We expect the higher cost of borrowing to weaken the economy over the next year and lower inflation.

- Inflation fell to 8.2%, and core inflation rose by 0.6% to 6.6%.

- Cost of gasoline declined for the third month in a row.

- The consumer sentiment index in October is 59.8.

Retail spending is a big part of consumer spending that drives the US economy. For September, it points towards a slowing; retail sales historically are lower in September because of the month falling between back to school and the end of the year holidays.

- Sales were flat for September.

- Auto and parts sales are down 0.4%.

The housing market is weakening rapidly, exacerbated by affordability concerns. All signs suggest housing will continue to drag economic growth through the year’s balance.

- New U.S. homes fell a seasonally adjusted 8.1% in September to 1.44 million.

- Building permits rose 1.4% to 1.56 million in September.

After a disappointing August, U.S. vehicle sales rebounded to a five-month high in September. The gain was primarily the result of the greater availability of new inventory.

- U.S. vehicle sales rose 2.8% month-over-month (m/m) in September.

- Year-to-date volumes have totaled 10.1 million.

The growth rate in business investment is still reasonably robust, but after adjusting for inflation, it’s not as strong as it looks. It’s also slowed considerably since the U.S. emerged from the worst of the pandemic.

- Orders for durable goods fell 0.2% in August.

- Core orders (excluding defense and transportation) rose by 1.3%.

- September Manufacturing PMI® registered 50.9 percent, down 1.9 percentage points from August.

THE U.S. FREIGHT VOLUMES CONTINUED TO EXCEED LOW EXPECTATIONS

Since the pandemic recovery began, the manufacturing sector has expanded at the lowest rate.

- September Manufacturing PMI® registered 50.9%.

- 28th consecutive month of expansion.

· Demand eased, with the New Orders Index returning to contraction, New Export Orders Index in contraction for a second consecutive month, the Customers’ Inventories Index remaining at a low level, and the Backlog of Orders Index approaching contraction.

- Consumption declined to -5.3%.

- Production Index increased by 0.2%.

- The Prices Index decreased for six months and is not far from contraction.

The sustained growth in the logistics industry continues to be fueled by high levels of inventory and the associated levels of cost and utilization associated with holding them.

- The Logistics Managers’ Index was 61.4 in September, up (+1.7) from August’s 59.7.

- Transportation Capacity is up (+7.5) to 71.8.

- Warehousing Capacity was 44.3 in September, up (+2.1) from August’s reading of 42.2.

Inventories are merely in a holding pattern and will begin moving again when goods spending picks back up in Q4.

The U.S. freight volumes exceeded low expectations in September, with more buoyant demand than feared at the start of the peak shipping season.

- The shipments component of the Cass Freight Index® fell 2.9% m/m in September (-2.9% SA).

- On a y/y basis, the index was up 4.8%, accelerated from 3.6% in August.

The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, rose 0.3% m/m in September after a 1.9% m/m increase in August.

- The expenditures index was still 21% higher than year-ago levels in September, accelerating slightly from 20% in August.

- On an SA basis, expenditures fell 1.9% m/m in September, with shipments down 2.9% m/m and rates up 1.0%.

September order activity is further testimony that there remains a tremendous pent-up demand.

- Preliminary Class 8 orders for September jumped to 56,500 units.

- Preliminary trailer orders rose in September to 21,500 units, which is still down 24% from last year.

Dealerships need to keep more inventory to meet demand. Larger carriers have yet to maintain their replacement cycles, which continue to drive pent-up demand.