Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

EMPLOYMENT INCREASED IN EVERY MAJOR SECTOR OF THE ECONOMY LAST MONTH

There are still too many job opportunities and insufficient qualified candidates to fill them, so more is needed for the Fed, which expects a further downturn in the labor market.

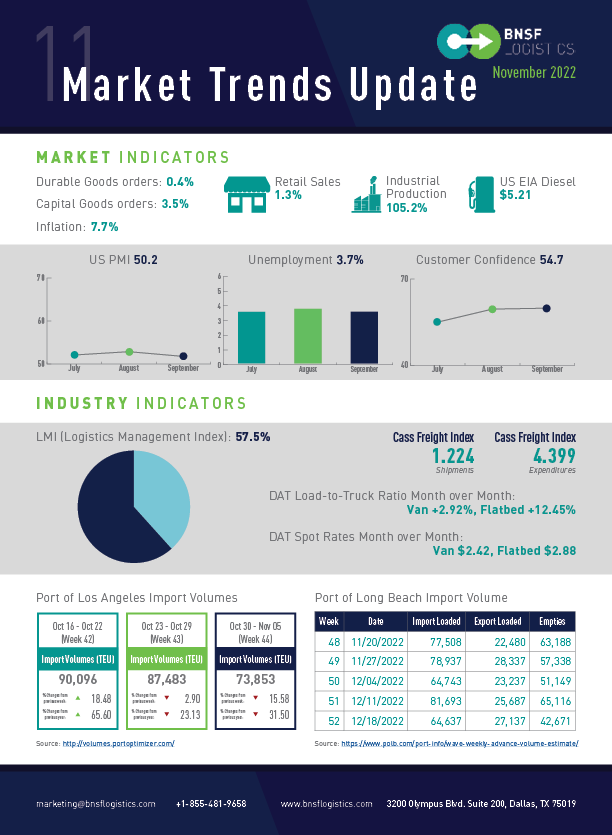

- The unemployment rate rose to 3.7% from 3.5%

- The U.S. added 261,000 new jobs in October

- The healthcare industry added 53,000 new jobs to lead the way

- Labor participation dropped by a tenth of a percent from 62.3 to 62.2

The price of gasoline jumped for the first time in three months following the OPEC oil cartel’s reduction in supply. Used vehicle prices fell for the fourth consecutive month.

- Headline inflation was up by 0.4% in October, lowering the annual rate from 8.2% to 7.7%

- Rents climbed by 0.7% in October, with grocery costs rising by 0.4%

- The consumer sentiment index in November is 56.8

Retail sales have suffered from high inflation, rising borrowing prices, and a sluggish economy, but not by enough to prevent Americans from making significant spending cuts.

- Retail sales increased by 1.3% in October

- Auto and parts sales rose 1.3% last month

In October, the US saw a fall in building new houses for the second consecutive month, a sign of weakening construction activity as the housing market raised mortgage rates.

- Housing starts fell 4.2% in October to a seasonally adjusted annual rate of 1.425 million

- Permits declined 2.4% in October

Sales of new light vehicles rose in October. A greater supply of cars caused the increase. On-the-ground and in-transit inventories increased at the end of October for the first time since May 2021.

- New light-vehicle sales in October totaled 14.9 million units, up 12.7% from last year

- The average price of a new car was $45,599, an increase of 2.7% over the previous year

The likelihood that manufacturing will experience a recession in the following months is rising. For most of this year, the sector has outperformed the survey data, but that difference is rapidly closing.

- Durable goods orders rose 0.4% in September

- Orders net of transportation and government spending fell 0.7% in September

- Orders for civilian aircraft jumped 21.9% in September

- Orders for cars and trucks rose 2.2%

TRANSPORTATION PRICES ARE NOW IN THEIR FOURTH CONSECUTIVE MONTH OF CONTRACTION

For the 29th month in a row, the manufacturing sector advanced. However, this is the lowest level since May 2020.

- October Manufacturing PMI® registered 50.2%, 0.7% lower than September

- Chemicals: Customers are canceling some orders

- Transport Equipment: Challenges with labor and parts delivery are easing

- Food & Beverage: The growing threat of recession is making many customers slow orders

- Machinery: We have seen a general pullback in available capital budgets from our customers

- Electrical Equipment & Appliances: The housing market is down, so our business is affected

- Fabricated Metals: Customer demand has been slower for two months

The COVID lockdowns in May 2020 caused October’s results to be the lowest, although they are still in positive territory.

- The LMI fell by 3.9 points in October from 61.4 to 57.5

- Transportation capacity was 73.1, showing that plenty of capacity is available

- Relief in Warehousing Capacity (58.3)

Inventories increased in October, although at a slower rate, with a reading of 65.5, down 6.4 from September, the weakest pace of growth since December 2021.

After a weak first half of the year, with freight demand impacted by inflation, a shift from products to services, and now surplus inventory, the recent turnaround has been perplexing.

- The shipments component of the Cass Freight Index® fell 1.4% m/m in October (+0.3% SA)

- On a y/y basis, the index rose 2.9%, decelerated from 4.8% in September

The expenditures component of the Cass Freight Index, which gauges overall freight spending, declined 4.9% in October after increasing 0.3% month on month in September.

- The expenditures index slowed to an 11% y/y increase in October from 21% in September

- On an SA basis, expenditures fell 4.0% m/m in October, with shipments up 0.3% m/m and rates down 4.3%

Component shortages remain an issue, but truck manufacturers are optimistic that improvements will continue throughout the first part of next year.

- Preliminary Class 8 orders for October were 43,200

- Trailer orders surged 91% from the previous month to 44,000 in October

Trailer manufacturers are in a Goldilocks environment. Despite concerns about the economy, demand for new equipment remains strong. I expect these conditions to last until mid-2023.