Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

THE ECONOMY STILL HAS PLENTY OF POWER

The on-going shortage of labor continues and is likely to add to the already high inflation rate. The size of the labor force shrank in April for the first time in seven months.

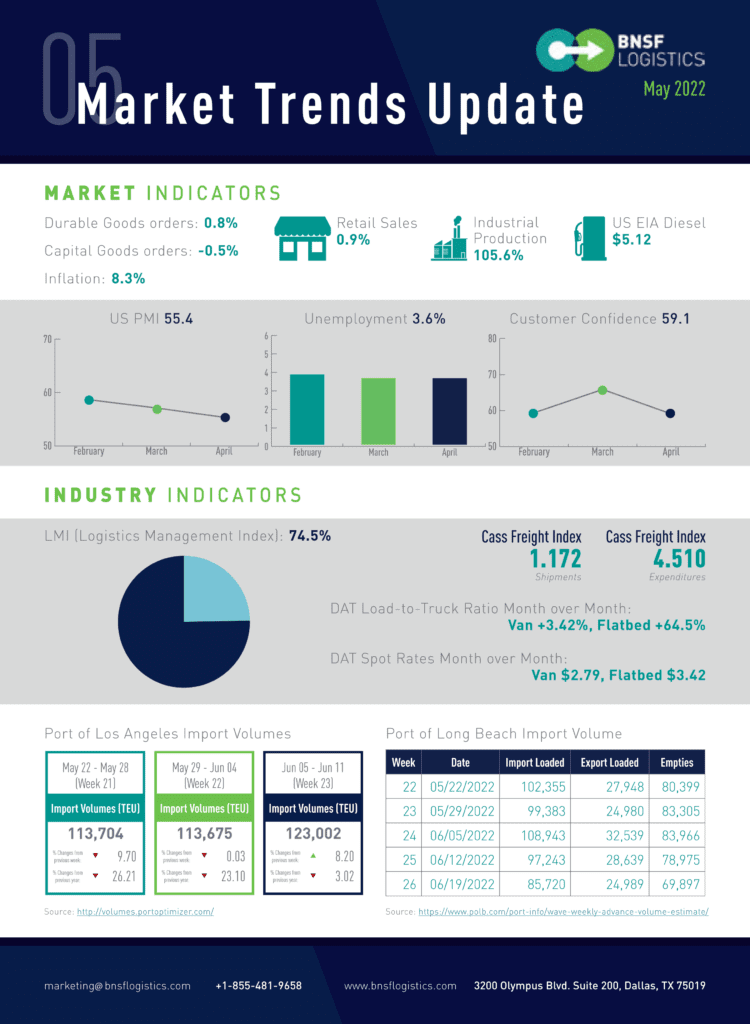

- U.S. unemployment rate was unmoved at 3.6% in April.

- Just above a 54-year low.

- The U.S. added 428,000 new jobs in April.

- Employment has grown by 400,000-plus for 12 straight months.

April signaled that the economy still is growing, but headwinds related to record inflation continue to weigh on consumers and is likely to start impacting consumer buying patterns.

- Sales at U.S. retailers rose 0.9%.

- Sales for March were revised upwards to 1.4% from an original 0.7% (inflation adjust).

- Inflation dropped slightly from 8.5% to 8.3%Consumer spending accounts for about 70% of U.S. economic activity.

In construction, multi-family projects of five units or more are rising. However, high mortgage rates and high prices are likely to reduce demand – especially for single-family units.

- New home construction declined 0.2% in April, to an annual pace of 1.72 million.

- The number of permits fell 3.2% to a 1.82 million rate.

- Single-family houses accounted for about 64% of new construction.

- Starts fell 7.3% to an annual rate of 1.1 million.

- Multi-family projects jumped almost 17% to a 612,000 annual rate.

Vehicles sales show a good sign in April, but the forecast remains below the expectation.

- U.S. vehicle sales rose 6.6%, rising to 14.3 million (annualized) units.

- Sales volumes were 1.23 million last month.

- Sales of passenger vehicles (10.7%) and light trucks (5.4%) were higher in April.

- Light trucks accounted for 78.3% of total monthly sales.

TRANSPORTATION CAPACITY IS BACK INTO EXPANSION

The overall economy is expanding for the 23rd month in a row after a contraction in April and May 2020.

- The Purchasing Manager’s Index (PMI) for April registered 55.4%.

- A decrease of 1.7% points from the March reading of 57.1%.

- Lowest reading since July 2020 (53.9%).

Manufacturing performed well for the 23rd straight month, with demand registering slower month-over-month growth (likely due to extended lead times and decades-high material price increases) and consumption easing (due to labor force constraints). In addition, overseas partners are experiencing COVID-19 effects, creating a near-term headwind for the U.S. manufacturing community. Fifteen percent of panelists’ general comments expressed concern about their Asian partners’ ability to deliver reliably in the summer months, up from 5% in March.