Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

THE ECONOMY CONTINUES TO SHOW RESILIENCE, BUT THE MARKET REMAINS TIGHT

The labor market continues to show resilience as we enter 2023, with the US economy creating 311,000 new jobs in February, a decrease from the 504,000 new jobs created in January.

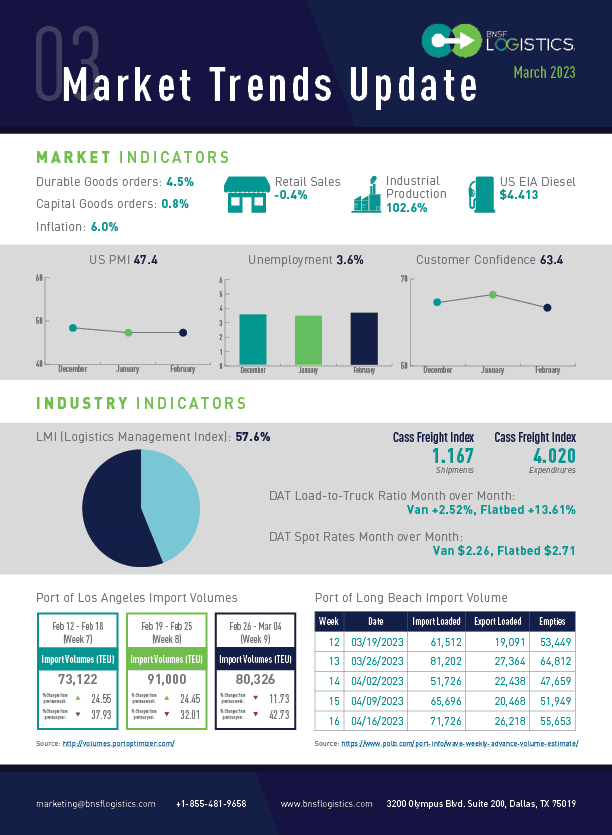

• Unemployment rate rose from 3.4% to 3.6%.

• Hourly pay was up 0.2% month over month, keeping the increase at 4.6% over the last twelve months,

• Labor participation rose again to 62.5% from 62.4% (still below pre-pandemic level of 63.3),

• Job openings remain elevated at 10.8 million at the end of January.

Headline CPI rose 0.4% in February – down from the 0.5% increase in January. The annual rate dropped from 6.4% to 6.0%. Core inflation has also been rising steadily.

• The University of Michigan Consumer Sentiment Index (MCSI) fell from 70.7 to 66.4.

• Core inflation rose by 0.5%

The U.S. retail sales for February were surprisingly low, dropping by 0.4% after a significant increase in January. This is the third decline in the last four months, likely pointing to a slowdown in consumer spending due to higher prices, higher interest rates, and decreasing disposable income.

• Sales of new vehicles and parts, a historically up-and-down category, dropped by 1.8%.

• Sales at gas stations decreased by 0.6% due to lower prices.

February saw a surge in new home starts, with the number of starts rising 9.8% from the previous month to 1.45 million homes. This growth was primarily driven by the construction of multi-family units, which increased by 24.1% compared to a 1.1% rise in single-family construction.

• Building permits for new homes rose 13.8% to 1.52 million in February

• Mortgage rates remain volatile for those looking at single-family units, but builders remain cautiously optimistic

February saw a slight uptick in vehicle sales, with over 1.1 million units sold. Although the seasonally adjusted annual rate of sales (SAAR) dropped from 15.74 in January to 14.89 in February, there is still cause for optimism.

• Inventories are improving as production delays due to chip shortages have abated.

• Expect to see more incentives later this spring as the selling season picks up

The manufacturing sector is expanding slower than last year, with tighter consumer spending expected to decline durable goods orders over the coming months gradually.

• New orders declined by 4.5% in January, mainly due to a decline in aircraft orders.

• Demand for new cars and trucks rose only marginally at 0.2%.

• Business investment rebounded, increasing by 0.8%.

CHINESE PMI IS GROWING, SUGGESTING THE ECONOMY IS RECOVERING

February’s Manufacturing PMI® registered 47.7%, the third consecutive month in contraction territory. This reflects the easing of demand and pressure on output/consumption. However, inputs remain supportive of future growth. Here are some key takeaways from the report:

• New Orders contracted slower, but New Export Orders remained in contraction territory.

• Customers’ Inventories remained “too low,” which is favorable for future production.

• Backlog of Orders is still in contraction but recovering.

• Output/Consumption had a combined negative 2.2-percentage point downward impact on the PMI® calculation.

• Supplier Deliveries indicated faster deliveries.

• Inventories expanded at a slower rate.

• Prices were back in expansion territory after four consecutive months of contraction.

The LMI was 54.7 in January, reversing two months of small growth, but inflation remains high, and consumer spending is falling. The Chinese PMI has been expanding the fastest since 2012.

• The future Transportation Capacity Index continues to indicate expansion, registering 62.9

• Transportation Utilization was 51.9 in February, a significant decline (-5.1) from the prior month.

• Inventory Levels 62.4 for the month was flat from January results.

Inventory levels, costs, capacity, and prices are all growing at normal rates, but the futures portion of the index is cooling, suggesting further expansion cooling. However, warehouse capacity is expanding for the first time since August 2020, and the future growth rate is 61.4, implying that firms expect more capacity in the coming year.

The Cass Freight Index® rose 3.8% m/m in February, extending a streak of stability from October through February. However, on a y/y basis, the index turned to a 0.3% decline after rising against an easy comparison in January.

• The expenditures component of the Cass Freight Index fell 1.9% m/m in February

• Inferred Freight Rates declined 9.4% y/y in February after falling 2.4% in January.

Preliminary Class 8 net orders for February were 22,800, a 10% increase from last February. Order levels are slightly below build rates, but with significant backlog will not impact overall production rates. It is anticipated that much of the new builds are for replacements rather than expansion.