Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

US LABOR MARKET AND ECONOMIC INDICATORS SHOW RESILIENCE AND COMPLEXITY

The US labor market showed marked resilience in May, surpassing expectations by adding 339,000 jobs, up from 294,000 the previous month.

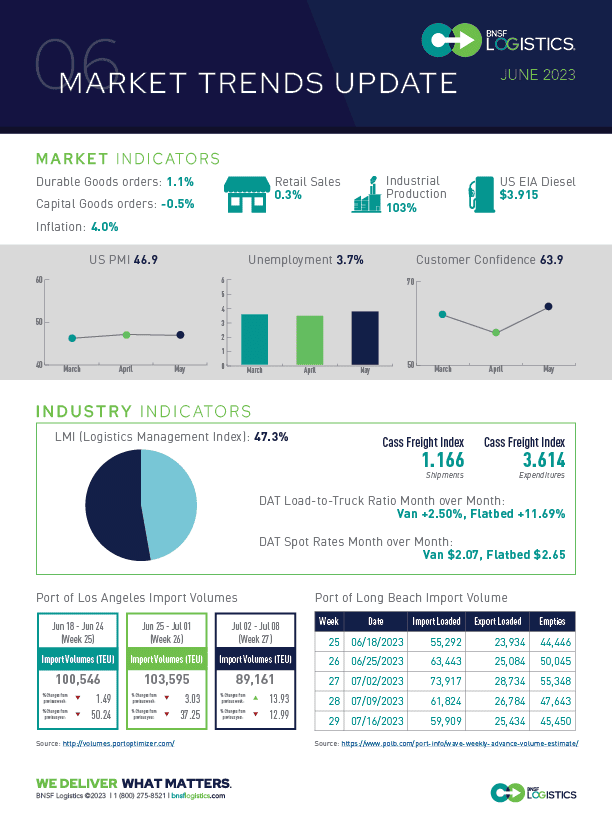

· There was a notable jump in the unemployment rate from 3.4% to 3.7%

· Hourly pay increased by 0.3%

· The labor participation rate remained stable at 62.6%

· The most significant job gains were in professional business services (64K)

The US economy has shown a mixed bag of results. While there was a slight increase in the number of jobs, specific indicators such as the Consumer Price Index (CPI) and the Consumer Confidence Index (CCI) paint a more complex picture.

· The headline CPI rose by a marginal 0.1% in May, down from a 0.4% increase in April.

· Consumer confidence declined from 103.7 to 102.3 in May.

Retail sales surpassed expectations by rising 0.3% sequentially, indicating the lasting durability of the economic expansion.

· Sales exhibited more robust growth at 0.4%

· Fuel prices fell by 2.6% during the month.

In May, the US housing market experienced a remarkable surge, with new home starts increasing by 21.7% to reach an annual pace of 1.63 million.

· Single-family and multi-family both see significant upticks, at 18.5% and 28.1%

· Building permits rose by 5.2% to an annual rate of 1.49 million units

New orders in April increased by 1.1%, primarily due to high military spending. However, orders witnessed a slight decline of 0.2% when transportation activity was excluded.

· The annual rate of business investment growth is 1.4%

· Industrial production experienced a dip of 0.2% in May

· Manufacturing output saw a meager increase of 0.1%

· May witnessed a 1.8% decrease in utility production

· Mining output (including oil and gas) declined by 0.4%

LMI CONTRACTS FOR THE FIRST TIME, AND THE FREIGHT MARKET NAVIGATES DOWNCYCLE

The Manufacturing PMI® continued to display contraction for the seventh month, settling at 46.9% after 2.5 years of expansion.

· Demand has experienced a downturn, with New Orders contracting faster. Simultaneously, New Export Orders have managed to reach a balance of 50

· Output/Consumption, encompassing Production and Employment, has shown positive signs. This sector has had a combined 3.4 percentage point upward impact on the PMI® calculation.

Supplier Deliveries indicate faster deliveries, and Inventories have fallen further into contraction. These factors are partially halting progress.

· LMI declined to 47.3 in May, down (-3.7) from April’s reading of 50.9. This is the first time in the 82 months of the LMI that the overall index has contracted.

· Inventory Levels were only slightly down (-1.5) to 49.5 in May

· Transportation Capacity was 69.3, down slightly from April

· Transportation Utilization dropped by 9.5 points to 45.5, putting the index into contraction

Inventory levels fell to 49.5, marking a contraction since February 2020, with a future index of 44.7 indicating further declines. Inventory costs decreased slightly to 64.4, with the future index at 54.4, suggesting a slower price expansion. Warehousing capacity increased slightly to 56.7, but the future index fell to 54.6. Warehousing prices dropped seven points to 62.8 due to improved capacity and lower inventory levels, with the future index at 60.5 predicting continued but slower price increases.

The Cass Freight Index rose in its shipments component by 1.9% in May but experienced a year-over-year drop of 5.6%.

· The expenditures component fell 6.8% month-over-month and 15.7% year-over-year

· Inferred freight rates saw a year-over-year drop in May

Preliminary Class 8 net orders for May were 13,600, reversing the prior months’ downward trend and rising by 9%, in line with order levels from 2022. There is a possibility for further reduction in the coming months as OEMs have filled all build slots for 2023, and 2024 order books still need to be opened.