Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

US JOB MARKET REACHED ITS HIGHEST LEVEL SINCE 1969, WITH 517,000 NEW JOBS CREATED

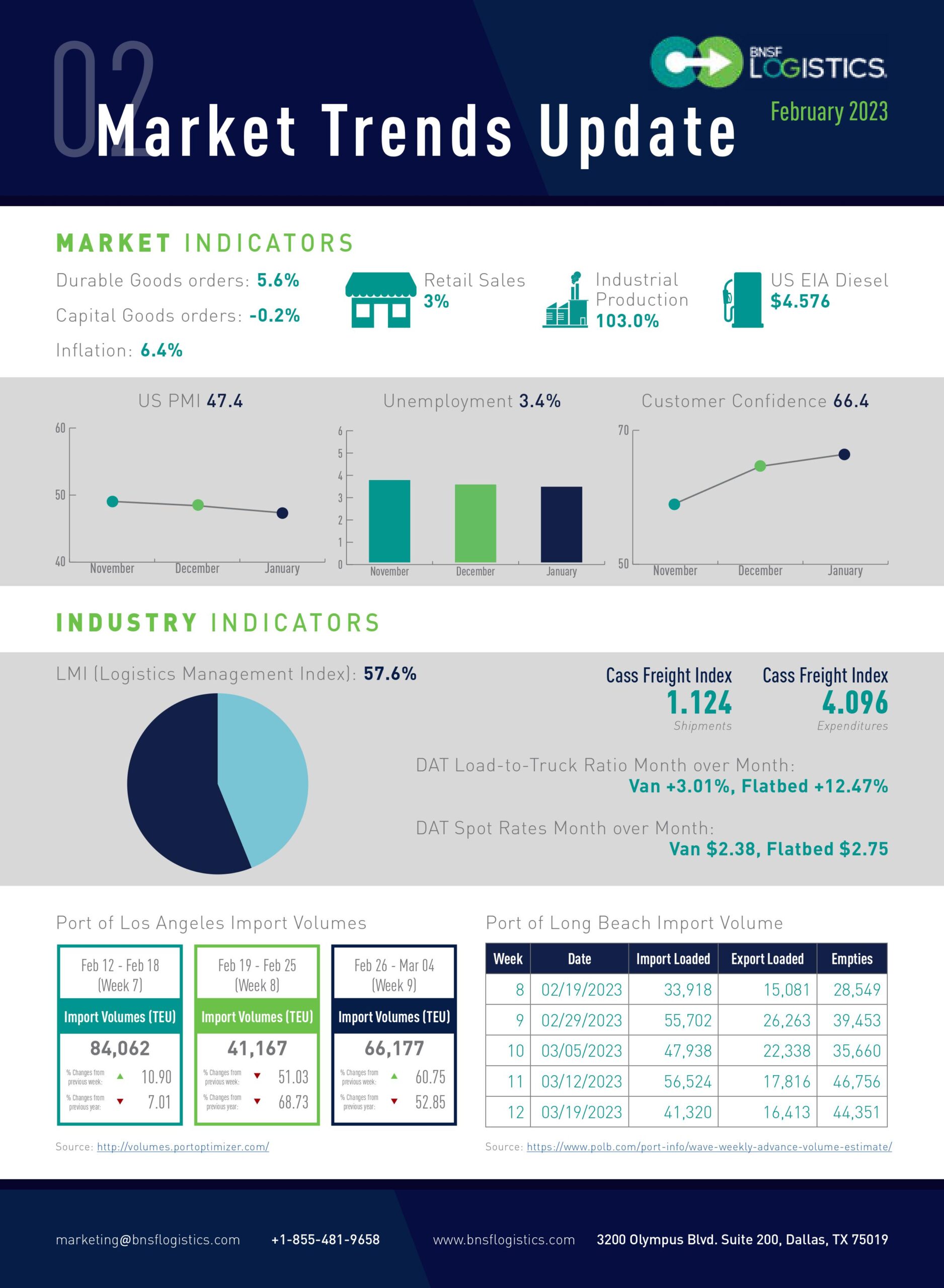

The US economy bounced back with 517,000 new jobs, representing the biggest gain in 6 months. As a result, unemployment fell to its lowest level since 1969, and the labor participation rate increased.

– Unemployment rate fell from 3.5% to 3.4%, the lowest level since 1969

– Hourly pay slowed from 4.8% to 4.4% over the last year

– Labor participation rose from 62.3% to 62.4%

– Largest gains were in hotels and restaurants (128K) and transportation and warehousing (23K)

The January Consumer Price Index (CPI) report revealed a 0.5% increase, the most significant increase in three months. The annual rate dropped from 6.5% to 6.4% despite the increase, and core inflation rose 0.4%.

– The cost of fuel was up 2.4% in January and receded in February

– Rents were up 0.7% in January, pushing the cost of housing to a new peak of 7.9% annualized

January’s retail sales report was a pleasant surprise for economists, with the largest in almost two years – beating estimates of 1.9%. After factoring out auto and fuel sales, the increase was still a robust 2.6%. In addition, sales rose in all major categories.

– Retail sales surged 3% in January

– Restaurants and bars saw a 7.2% increase after two months of decline

The housing market is showing signs of strain. Given buyer uncertainty, the data likely reflects builders’ reluctance to increase production. However, strong job markets and retail sales could pressure the Fed to raise rates faster, putting the housing market at risk.

– New home starts fell by 4.5% in January to 1.31 million homes; single-family permits fell 4.3%

– Building permits for new homes rose 0.1%, but single-family permits fell 1.8%.

The US Auto market remains precarious, with demand waning in the face of higher prices, rising interest rates, and low incentives.

– January as sales were up 4.5% year-on-year

– The SAAR rose to 15.74 million units, its highest level over a year.

December was a month of mixed news for the U.S. manufacturing industry. On the one hand, new orders increased by 5.6%, primarily driven by a 116% spike in aircraft orders. But, on the other hand, many different categories saw a sharp decline in orders.

– Aircraft orders rose significantly, with Boeing taking in 250

– Demand for new cars and trucks rose by less than 1%.

– Outside of transportation, new orders decreased for the second time in four months.

These figures suggest that the U.S. manufacturing industry is already in recession territory, with production being reduced in response to a slowdown in new orders.

PMI DROPS, BUT TRANSPORTATION CAPACITY AND INVENTORY LEVELS SHOW GROWTH

The January Manufacturing PMI® report showed that the manufacturing sector contracted for the second month with a reading of 47.4%. This is the lowest level since May 2020, indicating decreased demand and production.

– New Orders contracted strongly, while New Export Orders showed signs of improvement.

– Customers’ Inventories contracted slightly, which signals that future production should increase.

– Backlog of Orders contracted but is recovering.

– Output and Employment decreased, with Production contracting for a second month and Employment staying above 50%.

– Supplier deliveries increased faster than inventories, which suggests that companies are managing their supply chain effectively.

– Prices fell for the fourth month, albeit at a slower rate.

The Logistics Manager’s Index for January 2023 remained strong, with the overall index increasing 3 points from the December reading to 57.6. This reflects a general trend of growth in the transportation and warehousing sectors.

– Transportation Capacity rose to near all-time highs in January 2023, increasing marginally by 0.7 points from December’s reading of 69.5.

– Transportation Utilization saw a sharp increase of 8.9 points, rising to 57.0 in January 2023.

– Inventory Levels also rose in January, with a 5.2-point increase from December to 62.5.

Overall, January’s readings indicate a healthy and growing market. With the Logistics Manager’s Index remaining strong, the transportation and warehousing sectors will continue to see positive growth in the coming months.

The Cass Freight Index® latest report has some surprising results. Shipments fell 3.2% month-over-month. On the other hand, expenditures fell 3.2% month-over-month,

– Despite a drop in shipments, seasonally adjusted the index was unchanged from December.

– Expenditures returned to 1.7% year-over-year growth on an easy comparison.

Preliminary Class 8 net orders for January were 21,600 (4th month of decline), down 25% sequentially but only down 2% compared to last January.

Overall order levels are above replacement demand, suggesting fleets are still looking at some level of expansion.