Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

INFLATION RISES, WHILE JOB OPENINGS AND GROWTH SLOW

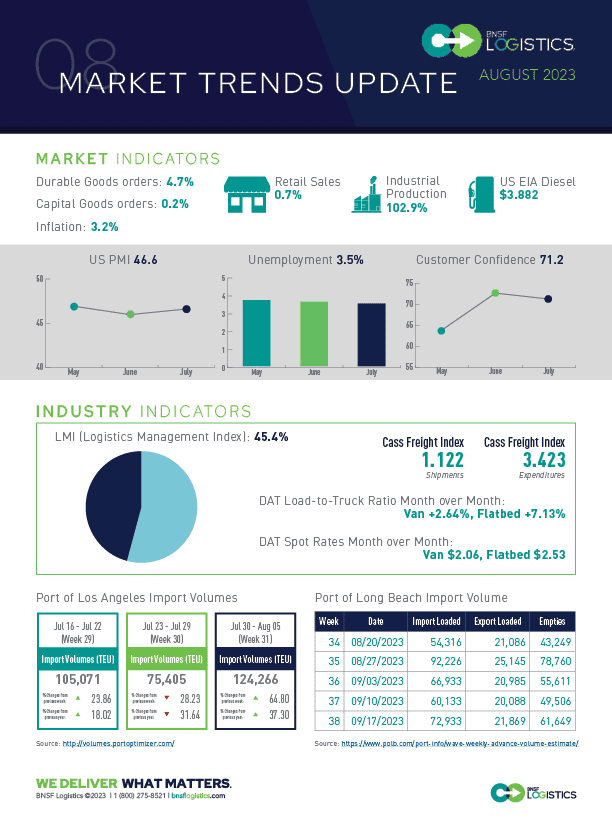

The US labor market showed new jobs created: 187,000 – up from a downward revised 185K increase in June – marking the first-time job growth has been below 200K for two consecutive months since the beginning of the pandemic.

• The unemployment rate fell slightly from 3.6% to 3.5%

• Hourly pay was up 0.4% in July, leaving the annual gain at 4.4%

• Labor participation was flat at 62.6%

• The largest gains were in healthcare (87K) and education (23K)

Most of the rise in inflation was due to rising housing costs, which were up 0.4% for the month and up 8% over the last year.

• Headline CPI rose 0.2% in July for the second month in a row

• Consumer confidence increased in July from 110.1 to 117.0

Retail sales in July rose by 0.7%, the biggest increase in 6 months.

• Strong internet sales due to Amazon Prime Day in July helped push up activity.

• Sales at restaurants and bars surged by 1.4%

• Real sales have largely leveled off since huge growth in 2021 and 2022.

New home starts increased by 3.9% in July to 1.45 million annual pace. This is still below May’s pace of 1.56 million.

• Single-family construction rose by 6.7% while multi-family was flat.

• Building permits for new homes rose by 0.1% to to annual rate of 1.44 million units.

New orders rose sharply in July by 4.7% due to significant orders of aircrafts. Net of transportation orders, the increase was a much milder 0.6% but still positive to see an increase versus contraction in this sector. Orders for autos rose by 0.3%

• Business investment slowed to a 0.2% increase

• Industrial production rose in July by 1.0%

• The output for mining rose by 0.5%

• Utilities rose by 5.4%

• Capacity utilization dropped from 78.9% in June to 79.1% in July

LMI INDEX FELL FURTHER INTO CONTRACTION TERRITORY, AND THE FREIGHT RECESSION CONTINUES

July Manufacturing PMI® stayed in contraction territory at 46.4 (but was up slightly from June’s reading of 46.0) for the ninth consecutive monthly decline

• Demand fell, with New Orders contracting, New Export Orders moving deeper into contraction, Customers’ Inventories showing movement to balance but still in contraction, and Backlog of Orders improving but still deep into contraction

• Output/Consumption (Production and Employment) was negative with a combined 2.1-percentage point impact on the PMI®

• Employment fell deeper into contraction

The shift in consumer spending to services versus goods indicates that the freight recession continues and is likely to continue until downstream participants look to replenish inventories.

• The LMI index slipped further into contraction territory in July with a reading of 45.4 (down from 45.6 in June) and marking the 3rd consecutive month in contraction

• Inventory Levels dropped further into contraction territory at 41.9 – down 1.0 point from June

• Transportation Capacity was 65.6 – down 5.6 points from June

• Transportation Utilization dropped further into contraction at 41.8 from 46.8

Inventory Costs continued to rise to 60.5. Future index shows prices to continue to expand, but with a reading of 60.4. Warehousing Capacity continues to loosen up with a reading of 64.4. Warehousing Prices were down slightly at 60.6 but still showing expansion. Future index was 63.4 (up 2.5 points) showing an expectation for continued price increases

The shipments component of the Cass Freight Index® fell 1.2% m/m in July on a seasonally adjusted basis. On a y/y basis, the index was 8.9% lower in July after a 4.7% decline in June.

• The expenditures component, which measures the total amount spent on freight, fell 2.8% m/m and 24.4% y/y in July

• Inferred Freight Rates decreased 0.8% m/m

Preliminary Class 8 net orders for July were stronger than expected at 13,500 (down 8% from June but up 25% from last July. Expectations have been for orders to drop even more, but that has not happened as build activity still is below replacement levels.