Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

THE FED INCREASED RATES ONE MORE TIME

The unexpectedly strong jobs report will probably drive the Fed to continue to hike rates in an attempt to push down demand.

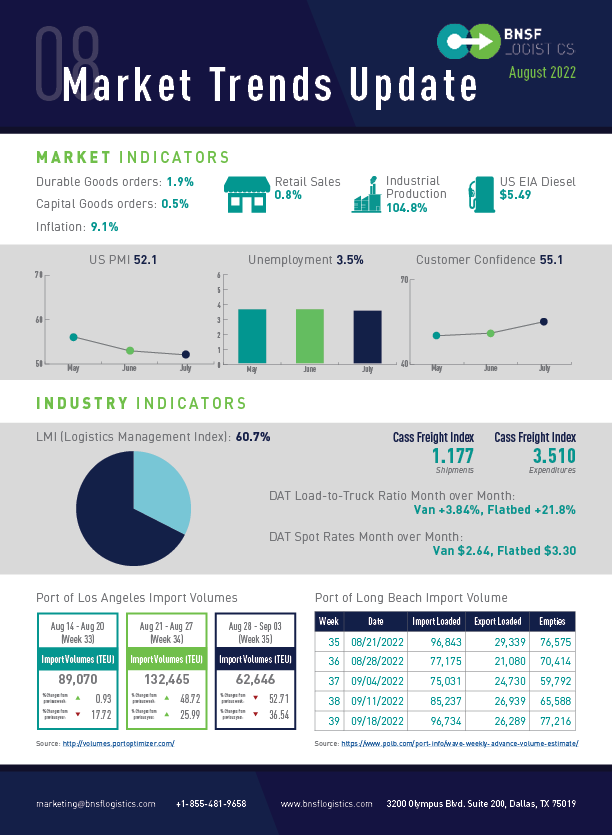

- The unemployment rate was 3.5%

- The U.S. added 528,000 new jobs in June

- The hospitality business created 96,000 new jobs

- The labor participation rate is down to 62.1%

Inflation showed signs of cooling in July because of a decline in gasoline prices. Excluding volatile food and energy prices, inflation in America gained 5.9% annually and 0.3% monthly in July.

- U.S. inflation is 8.5%, a decline from last month

- Gasoline prices fell by 7.7%

Sales at U.S. retailers were flat for the month, but this was primarily a result of lower gasoline prices and a decline in new vehicle sales. Sales were more robust at other businesses, a good sign for the economy that might help ease recession worries.

- Sales rose by 0.7%

- Auto and parts sales fell 1.6%

New home construction fell for the third straight month and was a much sharper decline than expected, with higher interest rates and inflation eroding purchasing power.

- Housing starts fell 9.6%

- New home sales plunged 12.6%

- New homes for sale rose by 18.5%

The auto market remains supply-constrained, but North American production is showing some signs of improving. Unfortunately, the modest improvement in inventories has so far done little to stem the tide on new vehicle prices.

- U.S. vehicle sales rose 2.5% to 13.4 million

- Year-to-date auto production is currently up 8.5%

- Prices for autos are up over 11%

Manufacturers have struggled over the past year to meet the crush of demand after the economy reopened from the pandemic, primarily because of ongoing labor shortages and crucial supplies.

- Durable goods orders jumped 1.9% in June

- New orders excluding the transportation sector were up 0.3%

- Orders for new cars and trucks rose 1.5% in June

THE OVERALL ECONOMY KEEPS EXPANDING, BUT THE RATE OF GROWTH IS SLOWING

Price expansion eased dramatically in July, but instability in global energy markets continues.

- July Manufacturing PMI® is 52.8% down 0.2% from the prior month

- 26th-month expansion in a row but demand is dropping

- The Customers’ Inventories Index remains low but approaches 40%

All the six biggest manufacturing industries — Computer & Electronic Products; Machinery; Transportation Equipment; Petroleum & Coal Products; Food, Beverage & Tobacco Products; and Chemical Products — registered moderate-to-strong growth in July.

The logistics industry had a healthy rate of expansion, which is a far cry from March when the index hit an all-time high reading.

- The LMI June reading was 65.7, which is down 4.7 points from June

- Transportation Prices were at 49.5 in July

- Transportation Capacity is 69.1

GDP was negative for the 2nd quarter with a seasonally adjusted rate of growth showing a 0.9% contraction. Real GDP was up by 2.7%, but when adjusting for the unseasonably elevated levels of inventories, we see a decline.

The shipments component of the Cass Freight Index® rose 0.4% on a y/y basis in July, after a 2.3% decline in June.

- On a seasonally adjusted (SA) basis, shipments rose 0.6% m/m in July, after a 4.1% decline in June

- Freight demand has flattened out this year with inflation near 9%

The expenditures component of the Cass Freight Index® fell 3.6% m/m in July from the record level in June, evenly split with shipments down 1.7% and rates down 1.8%.

Preliminary North American Class 8 net orders for July fell to their lowest level since November 2021; order activity was the weakest for the month of July since 2019. July is typically the weakest order month of the year, so it is no surprise orders dipped.

- Class 8 net orders for July are down to 10,600 units m/m, down 33% from June

- Preliminary trailer orders fell back in July by 28% from the final trailer orders reported for June to a total of 17,000 units

July is typically the weakest order month of the year; order volumes will probably improve in Q4 as OEMs begin filling their production schedules for 2023. While trucking conditions have, as of late, suffered because of weaker market dynamics and increasing costs, overall demand for new equipment remains exceptional and is expected to stay strong.