Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

CONSUMER SENTIMENT REMAINS BELOW AVERAGE EVEN AS THE JOB MARKET REMAINS STRONG

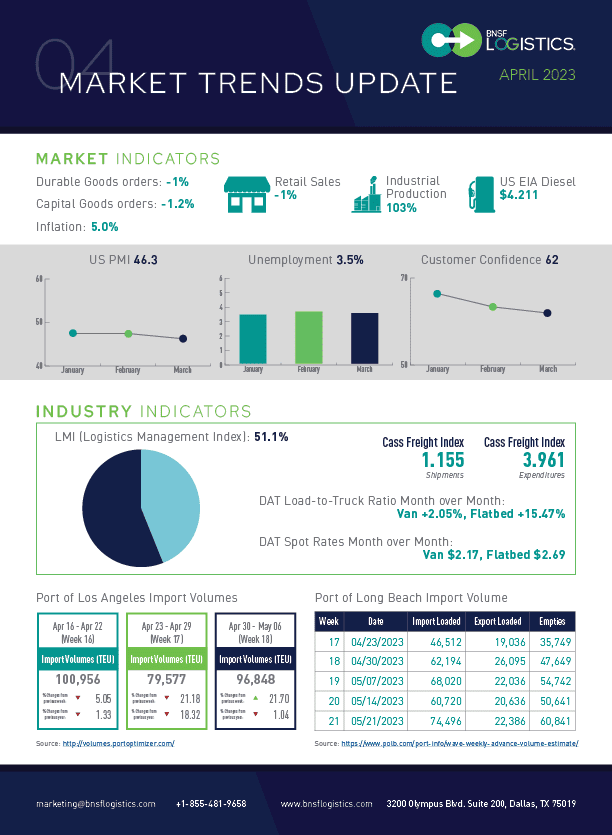

The US economy added 236,000 jobs in March, down from 311K in February. As a result, the unemployment rate fell from 3.6% to 3.5%.

• Labor participation rose again to 62.6% from 62.5%

• Hotels and restaurants saw the most significant gains, adding 72K jobs

• Government payrolls increased by 47K, while retailers cut 15K jobs

• Job openings fell by 900K at the end of February to 9.9 million

The Consumer Price Index (CPI) rose 0.1% in March, while core inflation increased 0.4% during the same period. Consumer confidence also increased slightly, with the Present Situation Index dropping from 153 to 151.1 and the Expectations Index rising from 70.4 to 73.0.

• Food prices fell for the first time since September 2020 but are still 8.4% higher than last year.

• Rents were up 0.5%, and prices of used vehicles fell for the 5th straight month.

The retail industry has seen a series of slowdowns in the last few months, with sales dropping by 1% in March for the second consecutive decline.

• Sales of new vehicles and parts declined by 1.6% in March

• Sales at gas stations dropped by 5.5%, expected to rise in April

The housing market saw a setback in March, with new home starts falling by 0.8%. In addition, building permits for new homes also dropped by 8.8%, indicating a continued downward trend.

• Single-family construction increased by 2.7%, while multi-family dropped by 6.7%

• Building permits for single-family rose by 4.1%, while multi-family fell by 24.3%

February saw a 1% decline in new orders, resulting from reduced orders for aircraft and vehicles. Business investment rose for the second month in a row, but rising prices and borrowing costs impact orders and businesses’ ability to invest.

• Demand for new cars and trucks dropped by 1%

• Orders are 2.3% lower than in the same period last year, the lowest YOY increase since 2020

• Business investment rose for the 2nd month in a row – up 0.2%

PMI® SLIPS, ECONOMIC SIGNALS POINT TO SLOWING GROWTH AND LOWER INVENTORY COSTS

March Manufacturing PMI® fell to 46.3 percent, signaling the fourth month of contraction after two and a half years of expansion.

• New Orders contracted faster, while New Export Orders and Customers’ Inventories declined.

• Output/Consumption, including Production and Employment, were in contraction territory for the fourth month.

• Supplier Deliveries improved, and Inventories fell into contraction, indicating potential for future growth.

LMI was 51.1 in March – down 3.6 points from February. This is the index’s lowest reading since its inception 6.5 years ago and is led by the continued decline in Transportation Prices.

• Transportation Capacity 71.4 in March, up 1 point from last month.

• Transportation Utilization 50.0 in March

• Inventory Levels 55.6 which was down 6.8 points from February

Inventory Costs were down 4.9 points from the prior month and 25 points from last March due to increased available warehouse space and declining inventories. Warehousing Capacity was up 1.6 points from last month, and the future index was 63.8. Warehousing Prices were down 2.4 points from the prior month but still in elevated expansion territory. Future index was 63.6 showing an expectation for continued price increases but at a slower pace.

The Cass Freight Index fell 1.0% m/m in March due to soft real retail sales trends and destocking, and normal seasonality suggests 1%-3% y/y declines for the next few months.

• The expenditures component of the Cass Freight Index fell 1.5% m/m in March

• Inferred Freight Rates were down 0.4% m/m after a 5.5% decline in February.

Preliminary Class 8 net orders for March declined 18% sequentially and are 11% below last March. The OEMs are still seeing a robust annualized rate of 340K units over the previous six months. Order levels are slightly below build rates, but backlog will not impact production rates. Overcapacity of the market is expected to lead to replacements rather than expansion.